Resimac Asset Finance (RAF), a division of ASX-listed Resimac Group Ltd (ASX:RMC), is one of the leading lenders outside of the Big 4 in Australia and New Zealand, and part of a leading non-bank lending group that has been providing bespoke lending solutions to consumers and SMEs for more than 20 years. In 2022, Antero partnered with RAF to revitalise their market offerings using Antero’s Incept, Australia’s most modern and customisable origination platform.

Partnership with Antero

Incept is more than just a software platform. When RAF selected Antero’s Incept as their origination platform of choice, they were forming a partnership with some of Australia’s best finance technologists. Central to ensuring the success of Incept at RAF was an onboarding process that aligned Incept’s powerful workflow engine and third party integrations with the processes of the organisation. Antero’s core belief is that their technology platforms should adapt to the client, not the other way around. Accordingly, Antero conducts a multi-phase onboarding project, including research, design & UX, process optimisation and general technology consultation to deliver a truly tailored solution that is unique to the client.

Why Incept?

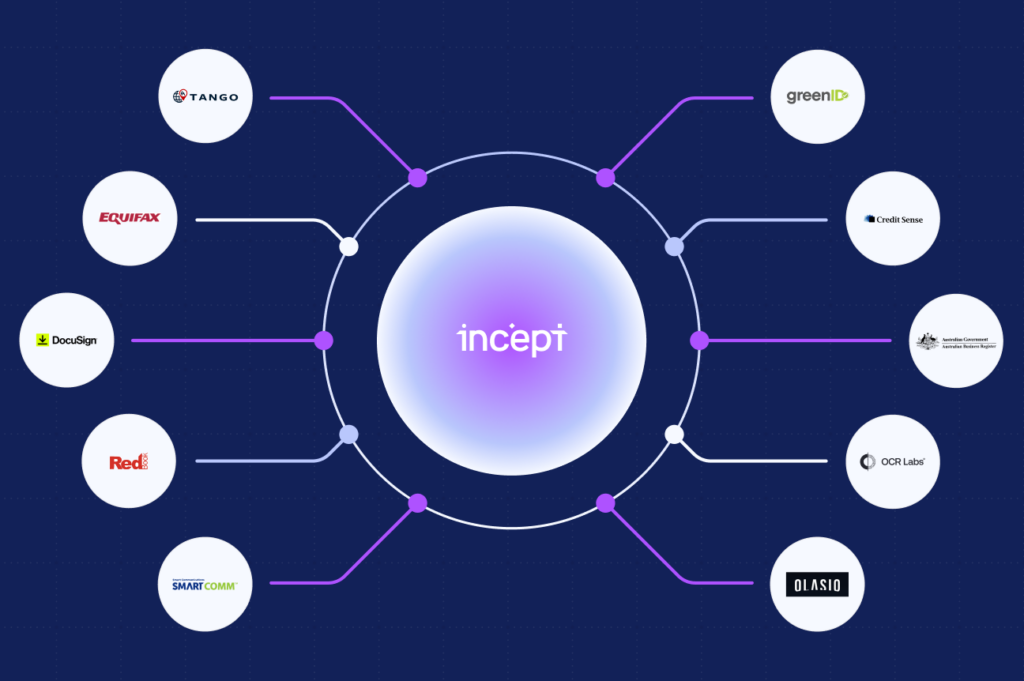

Whether you’re a startup or a long-established organisation, software interoperability is increasingly important for organisations who are looking to select the best tools for the various needs of the organisation. “All-in-one” platforms that initially seem like a convenient solution quickly box financial services organisations into simply levelling the playing field, making it difficult to differentiate on product and forcing a race to the bottom mentality to drive business.

Increasingly, Antero is noticing a trend of organisations embracing modern software platforms in order to gain an edge in being able to quickly adapt to rapidly shifting market conditions and offer unique products to the market.

The Incept origination platform offers incredible configuration driven agility for multiple simultaneous workflows with limitless integration potential for data and logic enrichment, making it highly attractive to industry players looking to have an “early to market” advantage. Deployed as a single tenanted solution on a per-client basis, Incept’s customers have confidence that their data is secure and that their specific business requirements are able to be met.

FROM THE CLIENT

“Exploring the market for a cutting-edge financial origination platform led us to deep-dive into several technologies. Antero’s Incept platform stood head and shoulders above the rest – it really impressed us with its ability to seamlessly integrate with and adapt to our business, without forcing us to reshape ourselves to fit its functionalities. It nailed our user experience and workflow needs, perfectly catering to our unique requirements.”

Seamless integration

to any third party

Incept’s industry leading workflow engine provides agnostic integration into any third party data or logic provider. This approach means it can be deployed into an existing ecosystem with the minimal amount of friction, while exposing organisations to a myriad of options when it comes to further data enrichment and process improvement. Resimac Asset Finance’s unique requirements around data and speed to decision means the seamless integration to third parties and processing of information offered by Incept gives them a competitive edge by letting them run their own race – supercharged.

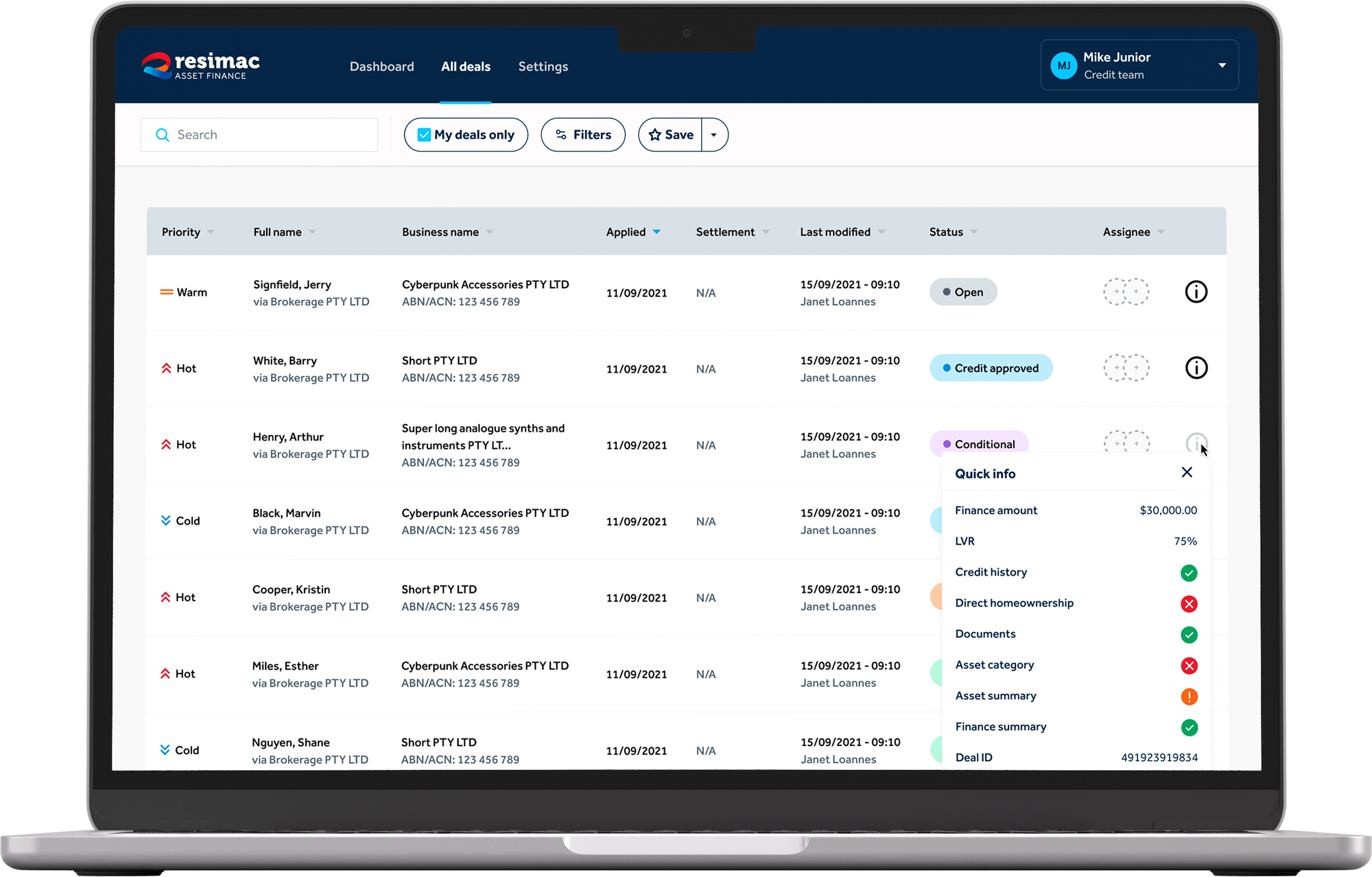

Connecting Brokers with industry-leading finance products

Incept provides a completely white labelled and configurable Broker Portal, centralising all interactions between brokers and RAF, from customer data collection, data enrichment, loan and repayment calculations, document generation and more – an end-to-end solution. Configured to match RAF’s rigorous compliance requirements, Incept gives RAF an edge with both speed-to-market for new products and time-to-decision for brokers and their clients.

The Broker Portal provides RAF and their brokers with lightning fast straight through processing capabilities, including:

FROM THE CLIENT

“Working with Antero has been a wonderful experience. As a fast-growing asset finance lender, we needed a scalable platform that we could trust to support a greater volume of loan originations and provide us with a strong foundation for the next phase of our business growth. Antero’s Incept platform was ideal from a technical perspective, but it was really the diligence and responsiveness of their team that made all the difference. For the past 18 months, they’ve worked closely with Resimac Asset Finance to really understand our business and deliver a solution that adapted seamlessly to the specific requirements of our suite of products. The Broker Portal in particular is a game-changer, as it has given us a fully Resimac-branded portal to engage with our brokers. Many thanks to the Antero team for being a critical part of our success moving forward.”

Charting a course into the future

Resimac Asset Finance is now live in market with their initial product offerings, with many more on the horizon. Having adopted the Incept platform, they have the ability to now extend their product offering rapidly and respond to market conditions in real-time. Antero is both proud to be partnered with Resimac Asset Finance as they chart this course into the future and excited for the opportunities that lie ahead.

Key outcomes

$1bn

Settlements achieved through to FY24 driven by the Incept Origination platform

5 minutes

Average application completion time

+240%

New settled customers since platform launch

Operational Efficiency

Lower operating expenses leading to operational efficiency

Procast turns Binnacle Training’s annual VET in Schools Conference (ViSC) into a hybrid live + stream event

End-to-end Digital Event Software, Production & Broadcasting